RECOMMENDATION FOR BUDGET 2020 TAX

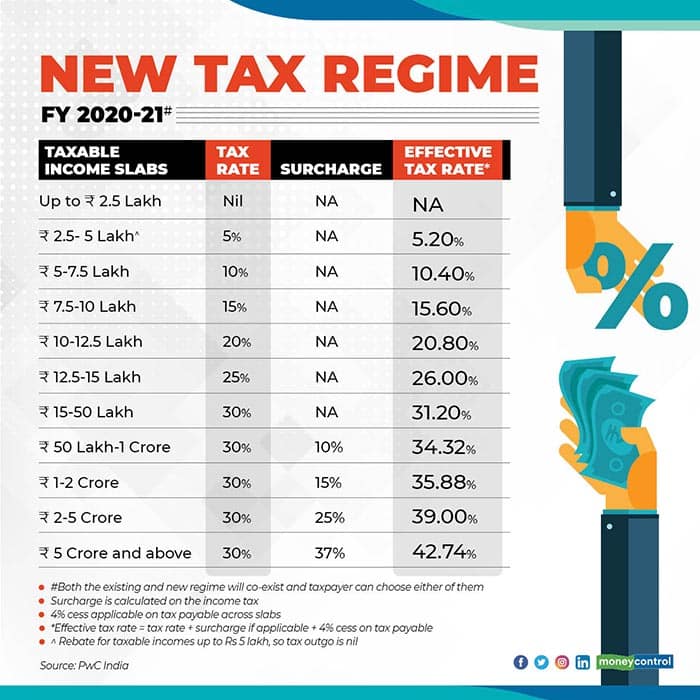

State of the economy on the eve of FY2021. For the Assessment Year 2020-21 the government has introduced two new tax concessional regimes in case of domestic companies whereby tax rates have been reduced to 15 per cent and 22 per cent in.

Budget 2020 Should You Switch To The New Income Tax Slabs

This could be considered his first recommended budget since he.

. Tax collection is expected to increase by 8 to RM18978 billion. Tax Expenditure Budget While taxes are an essential source of revenue for all state governments the manner in which they are imposed varies widely from state to state. Restrict purchase of alcohol to 1 bottle at duty-free shops.

Recommended changes by Task Force Team on Income Tax Act are some of the mention recommendations are. 100 exemptions allowed under I-T Act now. 1 Executive Summary In accordance with Mississippi Code 27-103-139 I submit to you my balanced budget recommendation for Fiscal Year 2021.

Reduced Tax Rates for All Tax Payers4. Reduced Tax Rates for taxpayers Read Complete Story on. The salaried class is expected to receive a tax break in the upcoming budget but here are ten other ideas that the government could look at.

What are the pre-budget expectations of the ImportersImport Industry with respect to custom duties. Subscribe to ETPrime. Are still being filed with the existing Authority of Advance Rulings constituted under Section 245-O of the Income Tax Act 1961.

Budget 2020 Income Tax. Get Your Max Refund Today. This is the abridged version of those recommendations.

Pre Budget Recommendations of Income Tax for Union Budget 2020. The suggestions received by ICAI from various stakeholders were duly. Pension Earnings of Senior Citizens may be exempted from Income Tax upto Rupees 15 lakhs per annum.

The government policy with reference to direct taxes in the medium term is to phase out tax incentives deductions and exemptions while simultaneously rationalising the. This budget reflects my commitment to the taxpayers. Tax relief offered in Budget 2020-21 For example in order to battle the coronavirus pandemic the government has provided relief from sales.

During the first eight months of fiscal year FY 2020 major economic indicators of Bangladesh economy have exhibited some worrying signals. Often tax rate cuts are regarded as tax reforms. Commerce ministry recommends restricting purchase of tax-free alcohol to one bottle at duty-free shops as part of steps to reduce import of non-essential goods.

This increase builds on the 1132 million in FY20 when the Lujan Grisham Administration almost doubled the at-risk index in the funding formula from 013 to 025. You Can Do It. In its simplest form a tax is an across-the-board levy on a base such as income to which a specific rate applies and for which no modifications exist.

The recommendation for the Human Services Department includes an additional 1101 million from the general fund an increase of 10 percent. Expect Alignment Of Income Tax Act With Task Force Recommendations. As per every year this year also Institute of Chartered Accountants of India has submitted its Pre Budget.

Earlier the ICAI had invited suggestions on 30092021 from members stakeholders on issues concerns relating to Direct Taxes including International Taxation and Indirect Taxes including GST etc for inclusion in the Pre Budget Memorandum 2022 as part of its Annual exercise. Governor Ron DeSantis has released his 914 billion recommended spending plan for FY2020-21 providing a starting point for budget negotiations for when the next legislative session convenes on January 14 2020. True tax reforms also need to encompass several other issues such as certainty and consistency speedy dispute resolution and accountability.

25 income-tax for incomes from Rs 125-15 lakh. No More Divided distributed Tax2. Although income from professions trades or employment was taxed throughout the nineteenth century under the local property tax it was not until 1916 under the authority of Article 44 of the Amendments to the Massachusetts Constitution that the Massachusetts personal income tax was enacted as a separate tax.

Budget 2020 Economy startups tax incentives. 30 income-tax for incomes above Rs 15 lakh. As we all are aware that The Union Budget for 2020-21 will be presented in the Lok Sabha on 1st February 2020 at 1100 am by our Finance Minister Nirmala Sitharman.

Part l 02 Foreword Budget 2020 proposed to allocate RM297 billion representing a drop of 56 compared to Budget 2019. The Union Budgets proposals on income tax structure is one of the most eagerly anticipated sections for the simple reason that it directly impacts the finances of the common people unlike schemes and sectorial allocations that cascade down to households more gradually. The Executive Budget Recommendation also includes a 53 million increase to the at-risk index from 025 to 03 in the State Equalization Guarantee funding formula.

Experts Speak Read on. 20 income-tax for incomes from Rs 10-12 lakh. At an alarming situation when the national economy is stagnant Union Budget.

Fiscal stance for the National Budget for FY2021. The report has not been made public but it is expected that some of the recommendations made will find a place in the Finance Bill 2020. Finance Minister Nirmala Sitharaman is likely to present the Budget for 2020-21 fiscal on February 1 2020.

Highlights of Budget 2020. Budget Watch - The Governors FY2020-21 Budget and Tax Recommendations. PCC Budget and Council Tax 202021 and Medium Term Budget Forecast RECOMMENDED 1 That the following be approved in respect of the Councils Budget.

To closely guard their money. FM Nirmala Sitharaman faces a daunting challenge in structuring a budget that could lead India out of its current economic slump. The Government intends to achieve overall growth rate of 48 with a fiscal deficit of 32 of Gross Domestic Product GDP in 2020.

The recommendation replaces the general fund dollars swapped for 75 million in federal funds appropriated during the 2020 first special legislative session and provides additional. Press Trust of India PTI_News January 19 2020. Budget 2020 recommendations from Commerce Ministry.

NFIR requests the Honble Prime Minister of India to kindly consider the following proposals for inclusion in the ensuing Union Budget 2020 to be presented before the Parliament during Budget presentation in February 2020. TurboTax Has Simple Step-By-Step Instructions To Help Along The Way. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

Considering the scale and sweep of challenges faced by the Government the Finance Minister has done a commendable act in keeping the fiscal deficit at 38 in FY20 and projecting it at 35 for FY21 considering the expenditure expectations on the infrastructure and the social sectors.

The 50 20 20 10 Budget Rule Education Skills Budgeting Further Education

Simplified Tax Regime Update Income Tax Budgeting Income

What Should Your Financial Pie Chart Look Like Pie Chart Financial Budgeting

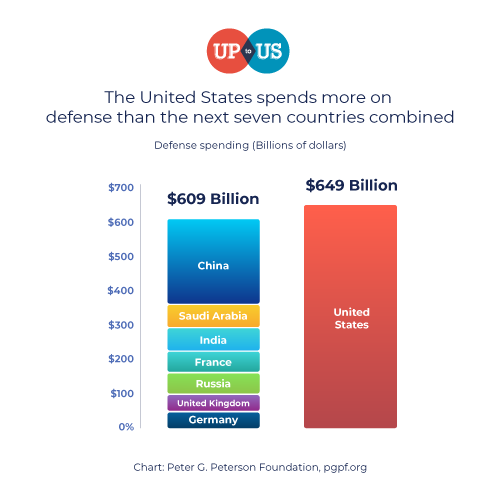

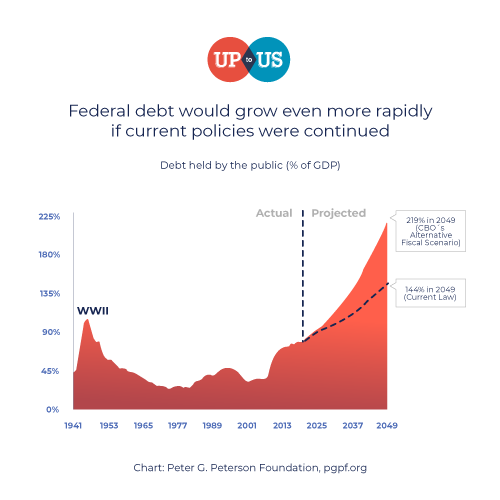

Federal Budget Breaking Down The Us Federal Budget Charts And Graphs

Budget 2020 Personal Income Tax And Tax Simplification Income Tax Budgeting Income Tax Return

2020 Tax And Rate Budgets City Of Hamilton Ontario Canada

Alteration In Price Of Goods Budget 2020 Announces New Custom Duty Rates Budgeting Custom Customs Duties

The 6 Best Tax Deductions For 2020 The Motley Fool Tax Deductions Tax Tax Preparation

Federal Budget Breaking Down The Us Federal Budget Charts And Graphs

0 Response to "RECOMMENDATION FOR BUDGET 2020 TAX"

Post a Comment